You landed the gig. You negotiated the contract. The number looked solid. But when that first paycheck hits your account, something’s off. It’s less than you did the math for. A lot less. Federal withholding, state tax, FICA, some local surcharge you’ve never heard of… it’s not a paycheck; it’s a financial obstacle course where half your money seems to vanish before the finish line.

For freelancers, contract warriors, and creators who get paid to perform the stunt coordinator on a 90-day shoot, the VFX artist on a project basis, the writer on a per-script deal this isn’t just annoying accounting. It’s mission-critical intelligence. Your quoted rate is the potential energy. Your net deposit is the kinetic force you actually have to work with. And in the high-stakes game of building a career and a life, you need to know your exact ammo count before you walk onto the set.

Your Location is Your Biggest Financial Variable (Not Your Agent)

Let’s say you book two back-to-back jobs. One is a three-month film shoot in Atlanta, Georgia. The next is a six-week gig at a studio in Los Angeles, California. Your day rate is the same. But your bank account will tell two very different stories.

Why? Georgia and California have completely different state tax structures. Throw in local city taxes, and the difference in your take-home pay could be the cost of your flight home, your new gear, or your rent for the month. Guessing is for amateurs. You need a precise, location-specific forecast.

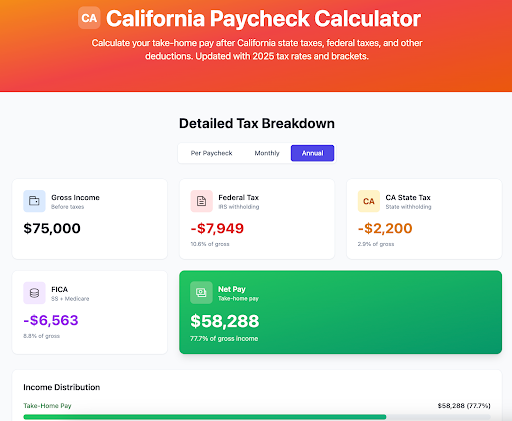

This is where modern tax tools online become your financial GPS. They don’t give you a national average; they plug in the exact tax codes for your work zip code. For a contractor considering jobs in New York, Texas, or California, this is the difference between knowing your real rate and just hoping it works out. A dedicated california take home pay calculator, for instance, will factor in the state’s progressive tax brackets and any local deductions, showing you the exact dollar amount you’ll clear on a Golden State paycheck.

Debunking the “Tax Bracket” Booby Trap

You hear it all the time: “Don’t take that raise, you’ll jump into a higher tax bracket and make less!” This is the financial equivalent of a movie myth it sounds logical, but it’s completely false. That’s not how progressive taxation works. Only the money you earn above a certain threshold gets taxed at the higher rate. Earning more always means taking home more.

A sharp, accurate paycheck calculator proves this. It gives you a line-by-line breakdown, a transparent after-action report on your earnings. It shows you exactly where every dollar is allocated, turning the opaque process of withholding into a clear, strategic briefing. It replaces anxiety with actionable intel, letting you evaluate a contract based on its real net value to your life.

Operate with Financial Clarity

For the independent operator, this kind of clarity isn’t a luxury it’s your tactical advantage.

- Negotiate from a Position of Absolute Knowledge: Walk into a rate discussion knowing your exact net pay for that city. You’re not just asking for a number; you’re negotiating for a specific lifestyle and financial outcome. You can say, “To net $X after California taxes, my day rate needs to be $Y.” That’s professional, unshakable, and commands respect.

- Budget Like a Strategist: Whether you’re allocating funds for off-season training, saving for your next equipment upgrade, or planning for months between gigs, knowing your exact cash flow is the foundation of survival and success. No more hopeful estimates. Just solid numbers.

- Compare Apples to Apples: That studio staff job with benefits? That juicy overseas contract? A great take-home pay calculator lets you factor in 401(k) matches, per diems, and health stipends to see the true total value of any offer, making your career choices data-driven, not desperate.

The Bottom Line: Know Your Real Worth

In the mission of your career, the contract is the objective. The net deposit is the prize you extract. Don’t let confusing tax codes and withholdings turn your hard-won victory into a financial puzzle.

Before you sign, run the numbers. Know exactly what you’re bringing home from every zip code, every job, every deal. Because in the end, the most powerful asset you have isn’t just your skill it’s the clear, calculated knowledge of exactly what that skill is worth, in your pocket, after the mission is complete. Get the intel. Then execute.