ITIN (Individual Taxpayer Identification Number) and SSN (Social Security Number) are the major tax requirements needed for staying on top when it comes to handling business transitions. ITIN and SSN have a distinct role and uses in the world of taxation and finance; however, both of them serve as identification tools. To ensure that you stay compliant with the law, understanding the difference between them is necessary. This also helps to save yourself from any useless complications.

Furthermore, only US residents have the right to apply for an SSN (Social Security Number), whereas on the other hand, non-residents go with an ITIN (Individual Taxpayer Identification Number). The main purpose of the SSN is to leverage the track tax contribution and earnings of every permanent resident. People who are not eligible for the SSN have the option to get ITIN, which allows them to comply with US tax laws. Let’s dive into this guide to know why these numbers have significant value in business translation and tax compliance.

What is an SSN, and Who Needs One?

SSN is the short form of the term Social Security Number, a collection of nine-digit numbers issued by the US government. To make sure that every individual is getting benefits, an SSN (Social Security Number) is used to track their earnings. Moreover, for tax reporting and filing, it has significant contributions. Permanent residents of the US citizens or anyone who wants to avail the government benefits need SSNs. The government identifies whether every individual is paying the correct amount of taxes or not with the help of this number. In addition, this number is also required if someone wants to open a bank account in the US. Non-US residents may also need SSNs who are willing to work in the United States of America.

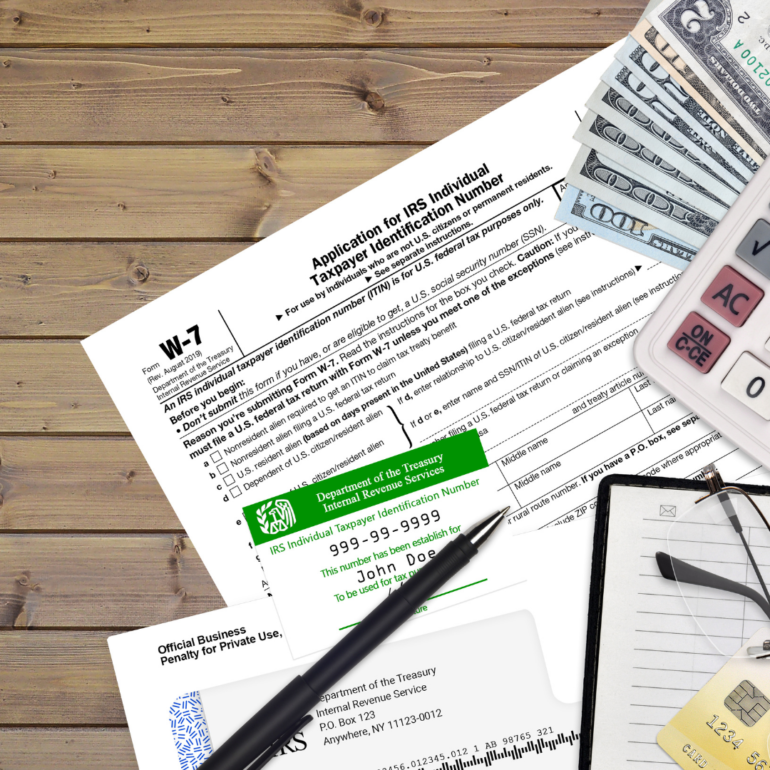

What is an ITIN and Who Needs One?

ITIN is the number assigned by the IRS to people who are not eligible for Social Security Number and need to file in the US. Normally, people who don’t have citizenship in the United States have the option to get this number to help them comply with government laws. A person having a job in the US can get this number in case he or she does not qualify for the SSN. This number is beneficial for people who are willing to meet their tax obligations and help the IRS track taxes owed by people, as explained by Tax Guys Inc. Having this number allows individuals to follow the law without the requirement of a Social Security number and assists them in claiming tax benefits and filing their tax returns.

Differences Between ITIN and SSN

Non-citizens use the Social Security Number (SSN) primarily for tracking their earnings and benefits; however, mainly it is used for citizens who have permanent US residence. Individuals who want to start their career in the United States need this number so that they can file their taxes. Many people confuse ITIN vs SSN, but they serve different purposes for individuals. The main difference between both of them is that ITIN provides support to those people who do not qualify for receiving SSNs. After having this number, non-residents can enjoy the benefits that are only reserved for permanent residents. ITIN gives access to very limited benefits, but on the other hand, SSN covers broader financial activities. Moreover, ITIN is mainly required to fulfill tax requirements.

How ITIN and SSN Impact Business Transactions

ITIN and SSN help identify individuals for tax and financial purposes, and both of them have a significant impact on business transitions. It is essential to have an ITIN (Individual Taxpayer Identification Number) or SSN (Social Security Number) to streamline business transitions. Businesses can effortlessly meet legal requirements and even report their income taxes with the help of these numbers. With the absence of these numbers, businesses not only can’t do any business but also may face fines and penalties, which may lead to damage to their company’s reputation. To stay in compliance with taxes and flexible business operations, SSN and ITIN act as key factors. Paying all taxes also provides you protection against fraud because other people know that your business is aligned with legal laws and it is not easy to do any unauthorized activity against you.

ITIN and SSN in Tax Compliance

For purposes of tracking individual financial activity, ITIN (Individual Taxpayer Identification Number) and SSN (Social Security Number) are important identifiers used by the government. Citizens who have permanent US residences can get Social Security and tax filing benefits after receiving SSNs, but on the other side, non-US residents can file taxes in case the government refuses to grant them SSNs while living in the United States. These numbers ensure that every taxpayer is uniquely identified in the system; they ensure that taxes are paid and income is reported correctly. They also prevent fraud. To make sure that everything is reported accurately, it is essential to have the right number.